Every day, financial teams juggle disconnected systems, compliance checks, and customer demands. Account onboarding crawls. Loan approvals stall. Manual steps pile up. The result? Frustration, risk, and cost. Kinetic brings order to the chaos. We connect your people, systems, and approvals into one secure, seamless flow that turns complexity into clarity.

KINETIC FOR FINANCIAL SERVICES

Orchestrate Trust at Enterprise Scale

THE CHALLENGE

What's Slowing Financial Services Down

Financial organizations don't lack technology. They lack orchestration. It's time for every part of the institution to move in sync.

Siloed data and legacy cores

keep teams in swivel-chair mode, rekeying data between systems.

Regulatory overhead

grows faster than automation, forcing expensive manual reviews.

Rigid workflows

make it hard to respond to new products or compliance rules.

Customer friction

erodes loyalty when onboarding or claims drag for days.

Visibility gaps

leave leaders blind to status, risk, and SLA performance.

OUR APPROACH

Orchestration That Connects Every Account, Policy, and Process

Kinetic unites your ecosystem without disruption. It overlays existing systems, automates handoffs, and gives every team clear visibility. The result is faster cycles, lower cost, and total compliance confidence.

What this looks like:

THE PLATFORM

What Powers It All

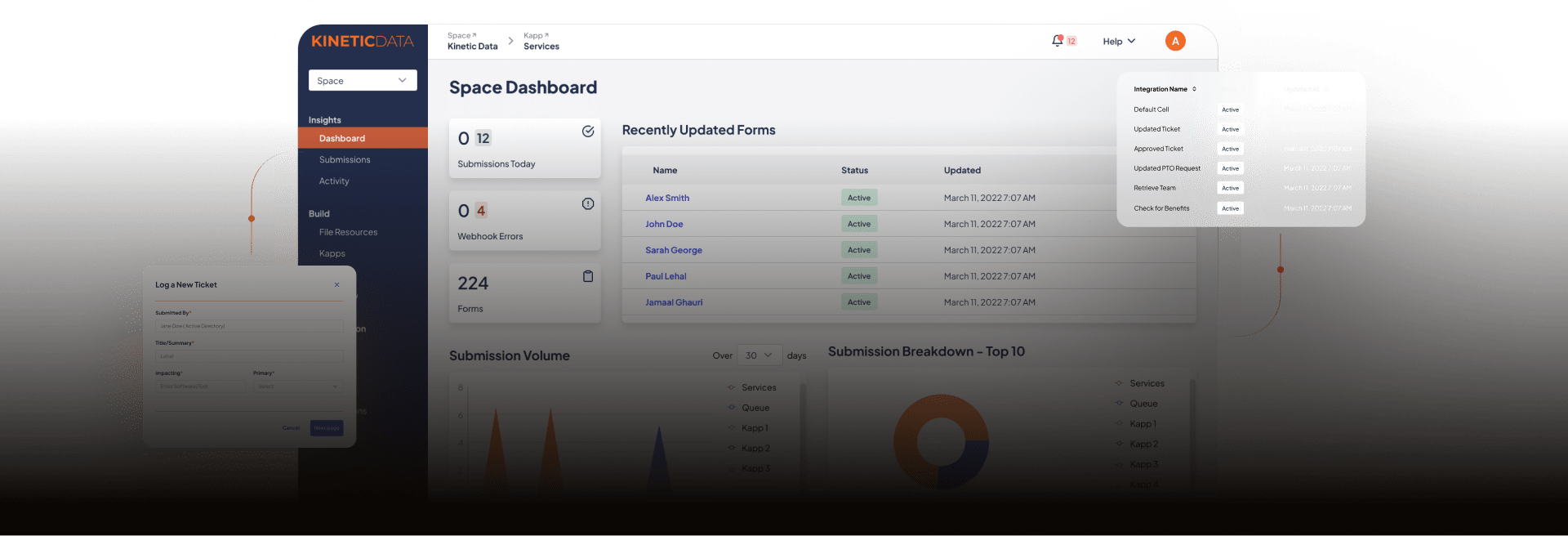

While powerful on its own, the true magic of our Forms component emerges when integrated with the broader Kinetic Experience Platform. Combine Forms with Workflows, Integrator, and Dev Tools to create a digital powerhouse that transforms every interaction into an opportunity for insight and innovation.

Experience Layer

One Portal for Every Relationship

Build unified, branded digital experiences for customers and employees. You own the interface, not the vendor. Every interaction feels consistent, fast, and on-brand.

Agility Layer

Workflows that Keep Pace with Regulation

Automate and adapt processes like onboarding, lending, and audits. Change approval rules or add compliance checks in minutes instead of months.

Real Results for Financial Leaders

70%

70% faster employee or customer onboarding

50%

50% fewer manual handoffs across finance, risk, and operations

100%

100% audit traceability and faster compliance reporting

"We manage access to upwards of 100-200 different systems, and not everybody needs access to everyone. One of the challenges before is we were doing that manually. A lot of that information lived in our heads... We wanted to systematize that and get that into the system."

See the Full Story

GreenState Credit Union automated employee lifecycle management, integrating HR and IT systems to ensure accurate and timely provisioning. The Kinetic Platform enabled system access automation, program provisioning, and role transitions while maintaining complete compliance.

Chris Troyer — IT Business Partner, GreenState Credit Union

Ready to Reimagine Financial Workflows?

Modern finance runs on trust, speed, and compliance. Kinetic helps your institution modernize without risk by connecting legacy cores, cloud apps, and human approvals into one transparent, auditable flow.